Don't let life insurance myths and misconceptions prevent you from getting the coverage you need!

Life insurance is an important tool for providing financial security for your family, and a topic that many people will find themselves looking into at some point in their lives. However, if you're just beginning to research the topic, we should first talk about some of the myths and misconceptions surrounding life insurance that you might commonly hear or see floating around the internet and social media.

Although we live in the information age, not all of that information is good information. As such, many folks have heard myths or hold misconceptions about life insurance, its use, its affordability, and who benefits from it.

Unfortunately, this might cause someone to miss out on a good opportunity that they later regret or otherwise make a bad choice based on bad information. So let's dive right in and debunk, dispel, and otherwise correct 6 life insurance myths and misconceptions. Read on!

What are some common life insurance myths?

Whether it's whole or term

life insurance, there's a lot of information to digest out there, which can make it hard to know what exactly is true. To clear the air and set the record straight, let's take a look at some of the most common life insurance myths and misconceptions.

1. It’s too expensive for me.

This is one of the most common myths or misconceptions about life insurance and one of the main concerns a person might have that prevents them from looking further into or applying for a policy; if you feel like a policy is out of your price range, you may not even bother looking.

Of course, the cost of coverage can range between people, policies, and providers; it's certainly

possible for a policy to be expensive, which is perhaps where people get this notion. But the truth is that for the average young, healthy person without abnormal risks in their life (like a

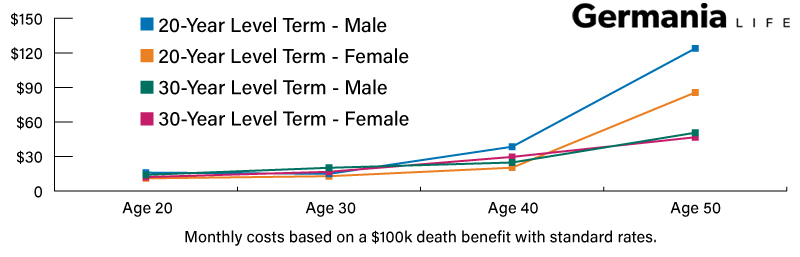

high-risk occupation or hobby), coverage is quite affordable. As an example, an average 30-year-old male can usually get a $100,000 30-year term policy for something like $20 a month, and somewhere around $24 if they're 40.

Many people require a greater coverage amount, to be sure, but the above example illustrates how affordable it can be.

2. Some people need life insurance, but I’m not one of those people; I'm young and healthy, I’m not married, I don’t own a home, and/or I don’t have kids.

Of course, if you are married, own a home, or have children, life insurance is a must; should the worst happen, you want to be sure that your family, or anyone else that depends on you, will be taken care of. But even if you don’t, there are many reasons people need life insurance, such as debt, student loans, possible funeral expenses, and more.

It's also worth thinking about your future; perhaps you don't have anyone depending on you

now, but what about five years down the road? What about ten? Securing a good rate for a life insurance policy earlier in life can put you in a great position to protect future responsibilities, too. You could wait until those responsibilities arise, but it will always be more expensive to do it later.

3. You have to get a medical exam to get life insurance, and I don’t want to go through that.

Life insurance medical evaluations can be an involved process that includes discussing detailed personal information, so it's certainly understandable if the prospect causes individuals to put off or avoid applying for a policy.

But the truth is that medical exams are not required for every policy or every applicant. Medical exams help life insurance companies assess the risk of providing life insurance coverage to an applicant. Most applications will ask for general information about your health, but young healthy individuals can often apply for certain policies without giving more specific information or going through an exam.

And for what it's worth, the medical evaluation can be a benefit to you regardless of the outcome. They are paid for in full by the life insurance carrier and can provide a lot of information about your health that you might find useful.

4. I don’t need life insurance because I have it through my employer.

Having a life insurance policy through an employer is a great benefit, but it is just that: an employment benefit. Just because you have one through an employer doesn't mean that you shouldn't consider getting a separate policy. You may not always be at that same employer and if you leave, you will likely lose that coverage.

Now, you might think that this isn't much of an issue because you can simply get a policy from a different provider at that time, which you certainly can do. However, it's important to think about the timing of it all. If, for example, you work for a company until you're 50 but then transition to a new employer, it could become difficult to get a low rate for the death benefit you had from your employer's policy.

For that reason, it's a good idea to consider a separate policy from the one provided by your employer. Getting a separate policy, such as a 30-year term life insurance policy, locks in a rate and death benefit that offers protection no matter where your career takes you.

5. Life insurance is only for funeral expenses.

It's not uncommon for people to assume that life insurance is really only meant to cover funeral expenses for you or a loved one. Perhaps this assumption comes from the fact that there are certain types of life insurance policies designed for that purpose.

Called "burial insurance" or "final expense insurance," these whole life policies usually have a much lower death benefit as they aren't intended to provide broad financial support for their surviving family members. They cover expenses like burial costs, funeral arrangement costs, or cremation costs and are usually aimed at people between the age of 50 and 85.

But this is far from the only type of life insurance and funeral expenses are far from the only use for a policy. Based on your individual situation and needs, the death benefit from life insurance can cover a variety of expenses that your family may be left with, from mortgages and living expenses to college tuition and even debt.

6. Life insurance is important, but I’m young so I can wait until I’m older to get it.

This is by far one of the most prevalent misconceptions held by people. People who are young and healthy may understand the benefits of life insurance, but because they are young, they feel that there is no reason to get it in their youth, or that they can wait to get a policy until they're older.

Of course, you can wait until you're older, but the truth is that there is never a better time to get life insurance than when you're young. Being young and healthy when you apply for a life insurance policy means you can get a larger, more affordable amount of coverage that remains the same for the duration of the policy.

But every year you wait, life insurance premiums begin to climb.

As an example, let's look at the cost of a 30-year level term life insurance policy. For an average female, the price difference between getting a policy at 20 and 40 is more than double; they would pay around $12 a month at 20, $30 a month at 40, and $47 a month at 50.

For a 20-year level term, policies are very affordable for both young males and females but increase substantially as you near 40.

Wrapping up

While we've cleared the air and provided insight into the truth behind these life insurance myths and misconceptions, it's also important to remember that some confusion can simply come from the fact that not all policies are the same. Sometimes, differences in providers, applicants, policies, or coverage amounts can lead to misunderstandings about what life insurance is and how it works.

For that reason, it's always a good idea to speak with a life insurance agent when reviewing coverage options. They can address your questions and concerns and help you decide what type of policy is right for your needs.

Germania is committed to providing Texans with Insurance they can trust. That's why Germania Life is here for all of your life insurance needs! If you have questions or want to learn more about life insurance, contact Germania Life at 1-800-392-2202 ext. 2060 or glife@germaniainsurance.com - or click here to get a fast, free quote online!

Germania is committed to providing Texans with Insurance they can trust. That's why Germania Life is here for all of your life insurance needs! If you have questions or want to learn more about life insurance, contact Germania Life at 1-800-392-2202 ext. 2060 or glife@germaniainsurance.com - or click here to get a fast, free quote online!